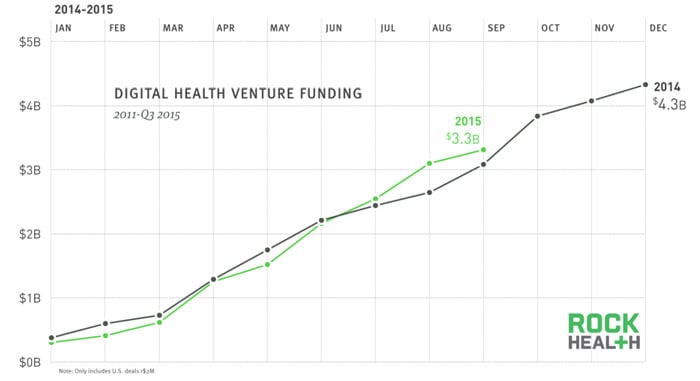

Shortly after StartUp Health has released its Q3 figures, we have Rock Health following suite with its own numbers. According to their researchers, venture investments for the first three quarters of 2015 have outpaced the 2014’s three quarter total with funding reaching $3.3 billion.

At $15.8 million, the average deal size is the largest yet, although deal count is down 9% compared to last year (when looking at US deals over $2M). The top 8 deals of the quarter contributed to over 50% of the quarter’s transaction value.

Seed stage and Series A deals are still leading the way with 57% of all deal volume, though there was an increase in deals for Series D or later.Seed stage and Series A deals are still leading the way with 57% of all deal volume, though there was an increase in deals for Series D or later, demonstrating the maturity of the market. In 2014, Series D+ deals represented 11% versus Q3 2015’s 14%.

The top six categories accounted for 56% of deal value through Q3 2015, and have remained fairly consistent from the mid-year. EHR / clinical workflow solutions is an exception as it has been replaced by personal health tools and tracking, and payer administration technologies thanks to two big deals – Helix ($100M) and 23andMe ($79M). The quarter also so investors putting money in services and technologies that are designed for seniors, with Honor’s $20M Series A leading this trend.

Additional categories that have experienced significant growth include: digital diagnostics and life sciences commercialization tools, which have shown 195% and 110% YoY growth respectively.

Rock Health has tracked a total of 146 M&A deals in 2015 to date.When it comes to M&A activity, Rock has tracked a total of 146 deals in 2015 to date. Of these deals, only forty-four had disclosed transaction values that totaled $5.1 billion. EHR and clinical workflow solutions accounted for 25% of acquired deal volume this quarter, making it the most popular target category. Also interesting is that 26% of the target companies were acquired by companies outside of healthcare, compared to only 19% in 2014.

Deal highlights from this quarter include IBM’s $1 billion acquisition of Merge Healthcare, Millennium Healthcare – HealthPath and MedX, and Cardinal Health’s deal to acquire 71% stake in naviHealth for $290M in cash.