Last year was a smashing success for the digital health industry, and this one managed to keep the pace, with digital funding in 2015 matching the total of 2014, while surpassing the $4.3 billion figure. In total, there were 278 deals worth $2 million or more across 248 companies, according to Rock Health.

The industry continues to account for a healthy 7% of total venture funding, the fact that should calm any concerns of a bubble. Digital health is no longer a novelty, with late stage deals accounting for just over 25% of all deal volume. Also, 2015 was a record year for industry consolidation, and we saw the M&A activity nearly doubling in volume — there were 180 deals and $6 billion in disclosed activity. Meanwhile, 5 IPOs brought $1.4 billion in capital to create $9 billion in market capitalization.

2015 was a record year for the number of late stage deals Series C and beyond.The largest theme of the year was the consumerization of healthcare, with healthcare consumer engagement, personal health tools and tracking categories accounting for 23% of overall funding.

Compared to 2014, this year saw a slight decline in the total number of deals, but the average deal size reached a new high at $15.6 million. Also, 2015 was a record year for the number of late stage deals Series C and beyond, which represented 18% and 25% of all deal volume, respectively.

When it comes to the average number of employees at digital health companies, it increased from 44 to 50 over the course of the past year, a significant bump from an average of 39 employees in 2013.

Thirty-four companies that closed a deal in 2014 raised at least one more round in 2015. The six largest deals of the year totaled to nearly $1 billion, representing 17% of all 2015 funding.

The top six categories accounted for 51% of all digital health funding in 2015.The top six categories accounted for 51% of all digital health funding in 2015, with payer administration entering the rankings for the first time. At $613 million, healthcare consumer engagement was the top category, followed by wearables and bio sensing ($489M), personal health tools and tracking ($407M), payer administration ($252M), telemedicine ($234M) and care coordination ($208M).

Investors who were most active in 2014 continue to invest in digital health in 2015, with 49 firms closing three or more deals.

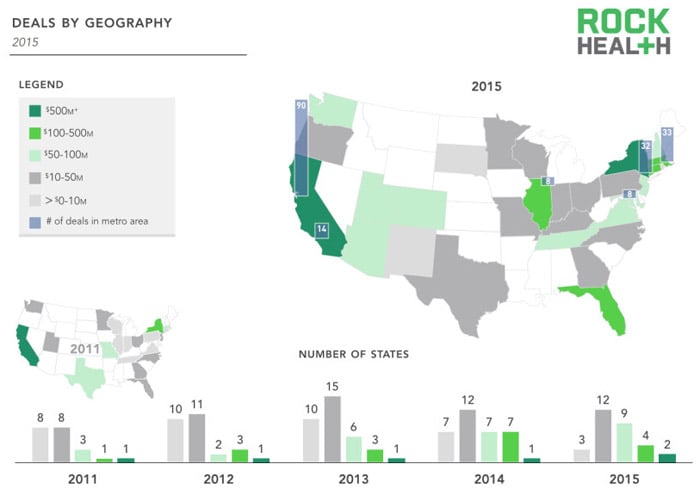

Geography-wise, California continues to garner the majority of funding — Bay Area-based companies accounted for almost 40% of overall digital health investments. Boston took the second spot, and New York City – third. Other metro areas worth noting are those of Miami, Salt Lake, Orlando, and Denver, each of which is home to companies that brought in more than $65 million.