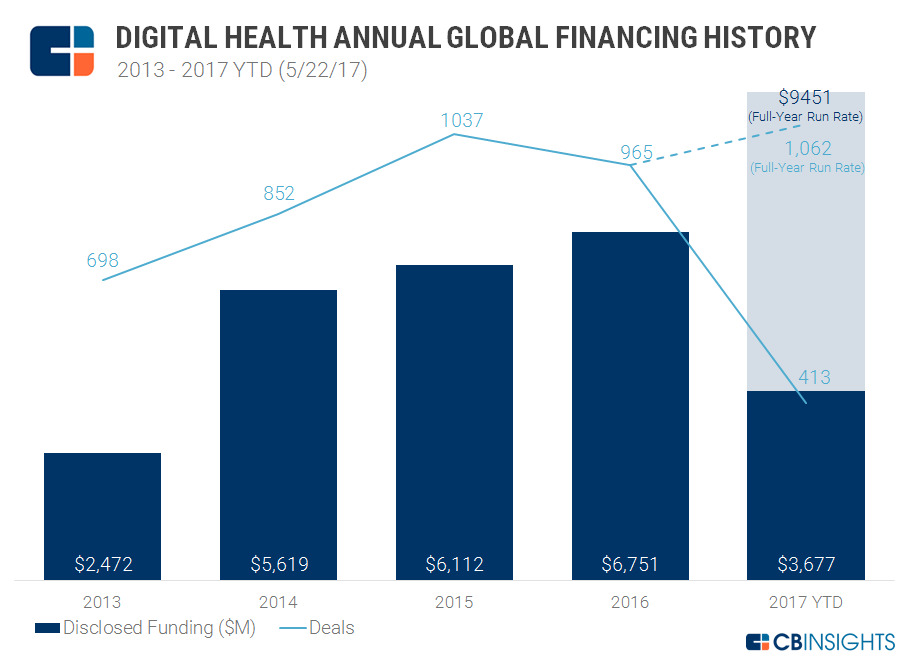

CB Insights released digital health figures from its comprehensive database, suggesting that the number of deals fell for the first time in 4 years in 2016. However, global funding into the sector grew for the 7th straight year in large part due to sizable rounds to Oscar Health Insurance and Ping An Haoyisheng.

This year, global equity funding to digital health companies has already reached $3.67 billion that is spread across 413 deals. At the current run rate, 2017 is on track to reach over $9.4 billion in funding across over 1000 deals, a potential 5-year high in total funding.

So far, the largest deals of the year include GRAIL’s $914M Series B from investors including Amazon and ARCH Venture Partners, Modernizing Medicine’s $214M equity raise from Warburg Pincus, and Hao Daifu’s $200M Series D from Tencent Holdings.

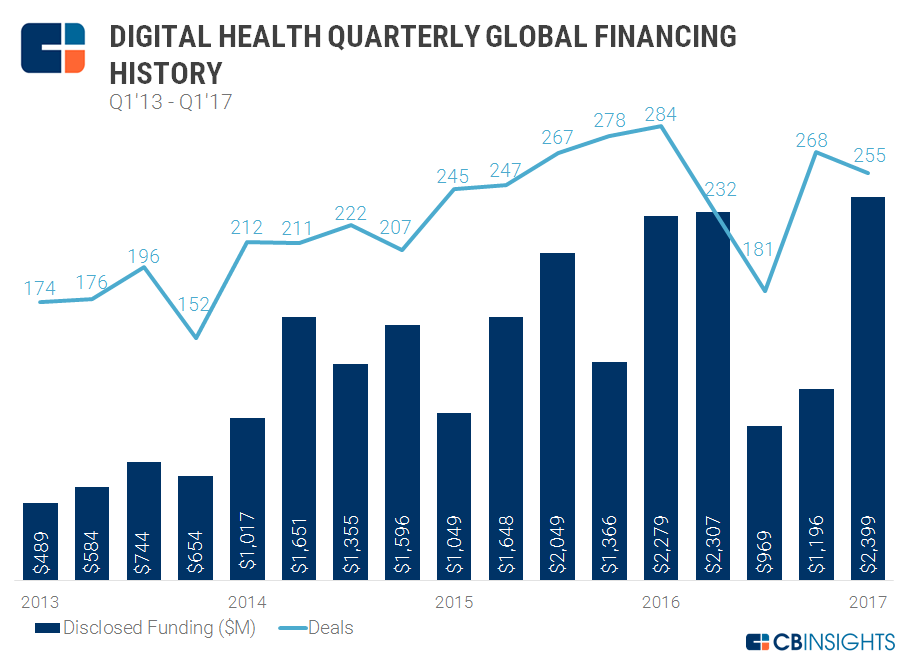

On a quarterly basis, funding saw a 100% increase from $1.2B in Q4’16 to $2.4B in Q1’17. Deal flow, however, fell slightly in Q1’17, landing at 255.

A few notable deals that occurred in Q1’17 include the $90M raise of health data and cloud computing platform Nuna, the $65M raise of cancer diagnostics startup Freenome, and the $115M raise of population health management company Alignment Health led by Warburg Pincus.

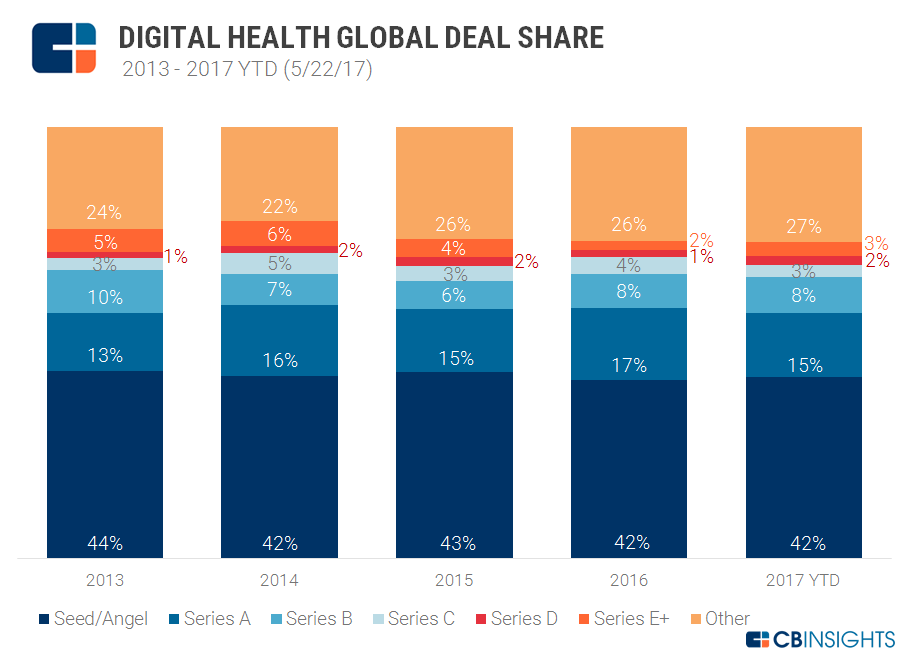

Although there were relatively few break out exits to date, investors appear to remain optimistic as early-stage rounds (seed and Series A) continue to receive the largest share of deal flow. In the past 4 years, early-stage deal share has not dropped below 57% of all deals to digital health startups.

Meanwhile, mid-stage deals (Series B & C) have hovered around 11% since 2013, while the late-stage rounds (Series D & E+) represented 5% of all deals in 2017 to date.