Wearable technologies will have a significant impact on the insurance industry, according to a survey of more than 200 insurance executives as part of Accenture’s annual Technology Vision report.

The report titled “Accenture Technology Vision for Insurance 2015-Digital Insurance Era: Stretch Your Boundaries” found that 63% of respondents believe that wearable technologies will be adopted broadly by the insurance industry within the next two years, while nearly one-third (31%) said they are already using wearables to engage customers, employees or partners.

73% of insurers said that providing a personalized customer experience is one of their top three priorities within the organization.Nearly three-quarters (73%) of insurers said that providing a personalized customer experience is one of their top three priorities within the organization, and half (50%) claim to already see a positive return from their investment in personalized technologies.

“While insurers have traditionally based their underwriting and pricing processes on a limited view of certain customer variables, emerging technologies such as wearables and other connected devices can help insurers break from their traditional business models and provide outcome-based services for their customers,” said John Cusano, senior managing director of Accenture’s global Insurance practice. “For instance, one leading insurer recently announced that it will provide new policyholders with a free fitness band to track their health progress – and then reward their healthy living with a reduction in life insurance premiums.”

However, more than half (56%) of respondents said that managing data is “extremely” or “very challenging” considering the changes in volume, variety and velocity. At the same time, 86% said they believe that software intelligence will be integral to simplifying their IT function.

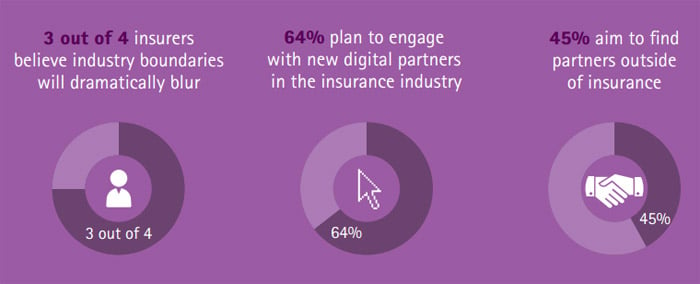

Finally three quarters (75%) of insurers surveyed said that industry boundaries will dramatically blur as platforms reshape industries into interconnected ecosystems, and the same number (75%) said they believe the next generation of platforms will be led by insurance players, not technology companies.