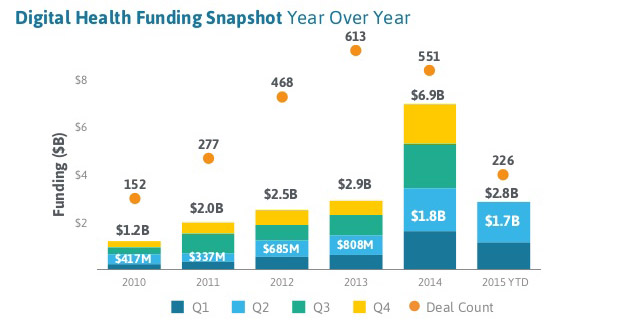

StartUp Health released its Midyear Report that highlights investments in the digital health market in the first six months of the year.

Overall, they’ve tracked 226 deals and a total of $2.8 billion in funding. In comparison, during the entire 2014, StartUp Health identified 551 deals that brought in $6.9 billion.

Top three deals include employee benefits manager Zenefits ($500 million), health insurer Oscar ($145 million), and life science company NantBioScience ($100 million).

Of all the deals StartUp Health has tracked, 25% were seed funding, 33% – series A, 24% – series B, 11% – series C, and 5% were series D.The top subcategory during the first half of 2015 was wellness and benefits, with $647 million raised, followed by patient and consumer experience which brought in $428 million in 46 deals, and big data and analytics that came in third with $333 million and 23 deals.

Of all the deals StartUp tracked, 25% were seed funding, 33% – series A, 24% – series B, 11% – series C, and 5% were series D. Both late and mid-stage deals had a median amount around $15 million, while the median amount for early stage deals was $2.4 million.

Khosla Ventures was the biggest investor and has supported as many companies in the first half of 2015 (9) as it did in the whole of 2014 (10). GE Ventures and Venrock also upped their investments, while Qualcomm, which led in 2014 with 12 deals, has only made 5 investments so far in 2015.

Finally StartUp Health tracked 19 M&A deals this half, 9 of which were made by big companies, 7 were made by startups, and 3 were made by funds.

[Via: mobihealthnews]