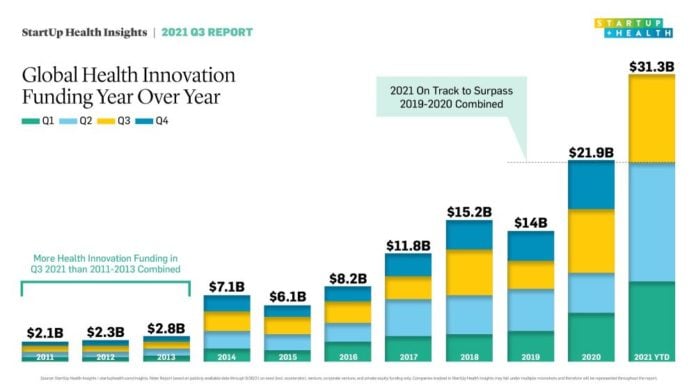

In the third quarter of 2021, StartUp Health tracked $9.7B in health innovation funding globally, bringing the year’s total funding to just north of $30B. That, in case you’ve been counting, is significantly higher than any previous full year on record. Those record-breaking numbers continue the sector’s multi-year growth trajectory and set health innovation funding on a course for 100% year-over-year growth. And if funding remains at current levels, we’re likely to see a year-end total around $40B, which is double of what was raised in 2020!.

Highlights

Deal size continues to grow

Of the 738 deals StartUp Health has caught in 2021, the median deal size was north of $41 million. That’s nearly a 3x increase in average deal size in just four years. While the larger deal size is a bellwether that health innovation is being taken more seriously, and is valued more highly, StartUp Health also believes in the power of the upstarts and the innovators and would also like to see the total deal count continue to climb.

Top deals in the U.S.

In the Q3 2021, the top six deals have to do with smoothing out the administrative side of healthcare, from ultrasound workflows (Exo) to speedier clinical trials (Reify Health). Also, there was one deal involving a fitness wearable – WHOOP. Noteworthy deals include the one for the interoperability software company Commure, which raised half a billion dollars for its “FHIR-compliant development platform for health systems, vendors and startups”; Olive, which brings enterprise AI to hospitals; XtalPi ($400M) for their AI drug discovery platform; and Carbon Health ($350M) for re-imagining primary care.

Top deals outside the U.S.

This quarter, the list of top deals outside the United States is topped by Miaoshou Doctor out of Guangzhou, China. Miaoshou Doctor is the latest healthcare infrastructure investment from Chinese powerhouse Tencent, and establishes the company as a catch-all ecommerce platform for everything from prescriptions to doctor consults. Combined with InferVision’s $140M raise (based in Beijing and number three on our list), this also solidifies China’s place back on the top deals leaderboard.

Also making the list of mega deals outside the United States is Deep Genomics, the Toronto-based company that raised $180M to expand their AI drug discovery platform; London-based Palta, which raised $100M for their preventative health platform that is helping folks live healthier lives through diet and exercise.

Also notable was the $97.5M raise by London-based Elvie, a women’s health company selling tech-enabled breast pumps and pelvic floor exercisers.

Innovation hubs

While San Francisco, New York City, and Boston continue to dominate both in dollars raised and in deals completed, there are a few notable entrants to the health innovation hubs lists, both in and outside the United States. Columbus, Ohio, punches above its weight this quarter, bringing in $405M in health innovation funding. That amount would place it in the second position on the international list, behind only London. In fifth position, Baltimore bests the more obvious tech hubs of Austin, Denver, Seattle, and Los Angeles. With eight deals for the year so far, Los Angeles is the most active city for health innovation funding outside of the big three (San Francisco, New York, and Boston).

Outside the U.S. – London has taken its place decisively at the top of our innovation hub list with 16 deals completed for 2021 so far.

Top investors

Seven of the top 10 most active investors in health innovation have already surpassed their 2020 total numbers, and there’s still a whole quarter to go. General Catalyst, Tiger Global, and Oak have blown by their 2020 numbers, a sign that firms are growing considerably more bullish on digital health.