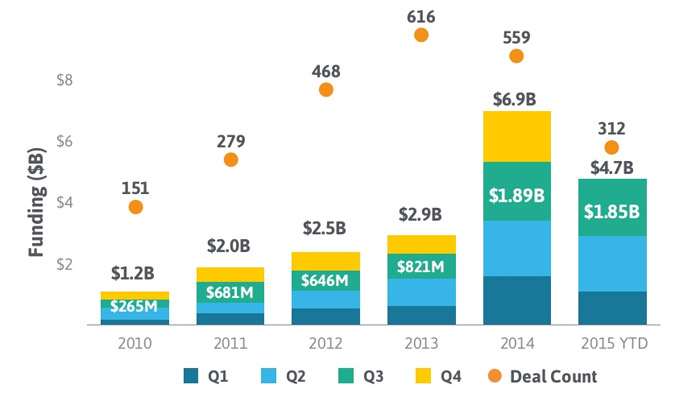

StartUp Health released Q3 figures that show that 2015 funding to date is slightly behind that of the same time last year. Nevertheless, the Q3 funding has increased and is comparable with the same period in 2014.

Overall, digital health startups have raised $1.85 billion in the third quarter for a total of $4.7 billion for the first three quarters of the year. In comparison, Q3 2014 saw companies raising $1.89 billion for a total of $6.9 billion for the entire year (2014).

Top 5 digital health deals include Zenefits ($500M), Guahao ($394M), Oscar Health ($135M), ZocDoc ($130M) and Helix ($108M).Q3 2015 continues to demonstrate a trend towards digital health market maturity with an increase of investment dollars combining with larger, less frequent deals.

Thus far this year, most active sectors were Patient / Consumer Experience ($1.1 billion) with 62 deals led by Guahao and Omada Health, Wellness ($876M, 32 deals, led by Headspace and Kfit), Personalized Health / Quantified Self ($461M / 23 deals / Helix, 23andMe), E-commerce ($409M / 17 deals / PokitDoc, Practo), and Workflows ($406M / 38 deals / Care at Hand, Kyruus). Big Data / Analytics, which was the leading sector last year, took 6th position in 2015 with $395 million spread across 30 deals — led by LaunchPoint and Metabiota.

Top deals include Zenefits with $500 million, Guahao ($394M), Oscar Health ($135M), ZocDoc ($130M), Helix ($108M), NantHealth ($100M), Clover ($100M), Practo ($90M), 23andMe ($79M), HealthCatalyst ($70M) and PlanSource ($70M).

San Francisco Bay Area holds the top spot in the U.S. with 81 deals and $1.6B raised, followed by NYC Metro Area, Boston, South Florida and Los Angeles.San Francisco Bay Area holds the top spot in the U.S. with 81 deals and $1.6 billion raised, followed by NYC Metro Area ($508M – 37 deals), Boston ($318M – 28 deals), South Florida ($248 – 12 deals) and Los Angeles ($245M – 12 deals). Other major cities on the list include Chicago, Salt Lake City, San Diego, DC Metro Area and Seattle.

Seed and Series A rounds are still leading the way with 64% of funding activity in 2015, with Series B and C rounds continuing to increase their share, again demonstrating the maturation of the market.

Leading investors include GE Ventures with 9 deals; Khosla Ventures (8); Fidelity Biosciences, Rock Health, Sequuoia, Tencent and Venrock – all with 7 deals. Other notable investors are Qualcomm Ventures, Zaffre, Cambia, Andreessen Horowitz, Founders Fund and Merck.